Finally in this section, let’s consider taxes and benefits together.

We have the usual diagram, but now all the fields for taxes and benefits together on the left. So it’s possible to design a complete system.

We’ve seen seen that you can understand the effects of taxes and benefits using the same concepts. Now, when we put the two sides together, we can analyse the results in the same way, but the tax side and the benefit side can interact in ways that produce complicated and often unintended outcomes.

For example, if tax allowances are low and the generosity of in-work benefits fairly high, it’s possible to pay taxes and receive means-tested benefits at the same time. Depending on the exact calculations involved, this can produce METRs in excess of 100% - earn more and net income falls1.

Exercise: we simply invite you to experiment here. Try to get a feel for how taxes and benefits interact.

The sometimes chaotic nature of the interaction of taxes and benefits have led to advocacy of the complete integration of taxes and benefits. Completely integrated systems are sometimes known as Negative Income Taxes; one such system was proposed for the UK in the early 1970s2. Universal Credit, briefly discussed above, is an attempt to integrate several means-tested benefits, though not taxes. However, though it produces messy and inconsistent interactions, there are often good reasons for keeping parts of the tax and benefit system separate. With Minimum Income benefits, for example, it’s often important to get help to people very quickly if they are destitute, whereas with an in-work benefit, it’s often helpful to take a longer view, so support can be given consistently over say a, year.

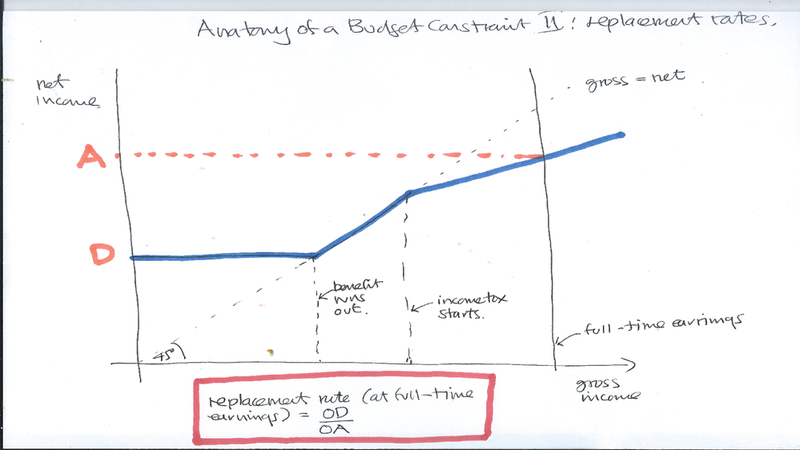

Now we have taxes and benefits together, we can introduce our fourth summary measure: the replacement rate. This is intended to be a measure of whether it is worth working at all, and simply the ratio between the net income someone would have when working some standard amount of hours (usually 40 per week), and the income received when not working at all.

The replacement rate is worth knowing about because it is sometimes used in academic studies trying to explain, for example, the aggregate level of unemployment; it also sometimes appears in popular discourse3.

Assuming an hourly wage of £8, use the form above to calculate replacement rates for 2 different tax and benefit systems.

Dilnot, Andrew, and Graham Stark. “The Poverty Trap, Tax Cuts and the Reform of Social Security.” Fiscal Studies, February 1986.

Sloman, Peter. “‘The Pragmatist’s Solution to Poverty’: The Heath Government’s Tax Credit Scheme and the Politics of Social Policy in the 1970s.” Twentieth Century British History, December 2015. https://www.repository.cam.ac.uk/bitstream/handle/1810/253514/Sloman%202016%20Twentieth%20Century%20British%20History.pdf?sequence=1&isAllowed=y.